Economic Overview

It was mostly a positive quarter for markets, with volatility across equities and fixed income being much lower compared to recent quarters.

In the US, the Federal Reserve left interest rates unchanged, but provided a more optimistic assessment of economic conditions at its July meeting, deeming that the risks in the near term had diminished.

In Europe, economic data continued to indicate lacklustre growth and low inflation. Annual inflation ticked up in September to 0.4% from 0.2% in August while GDP expanded by 0.3% in Q2, slowing from 0.6% in Q1.

In the UK, equities moved higher as the domestic political backdrop began to stabilise following the Brexit referendum vote. Equities were also supported as the Bank of England launched a series of monetary easing measures, but the British Pound was the worst performing major currency in Q3.

Chinese equities offered good gains over the quarter, with data showing GDP expanded by 6.7% year-on-year in the second quarter – in line with expectations. Share prices were supported by expectations of more easing from the Bank of China, given disappointing manufacturing and trade numbers.

In Australia, the RBA again lowered interest rates by 0.25% in August, noting that overall growth is continuing, despite a very large decline in business investment. Exports have been one bright spot, supported by the lower exchange rate.

Market Overview

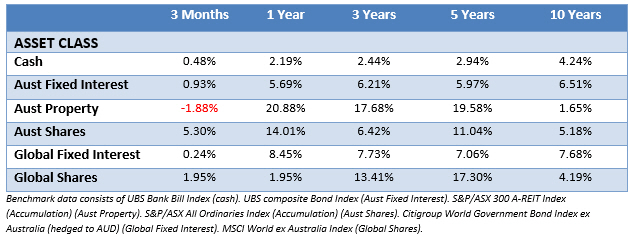

Asset Class Returns

The following outlines the returns across the various asset classes to the 30th September 2016.

Global equity markets completed a quarter of solid gains, with strongly positive value and small cap premiums in most markets.

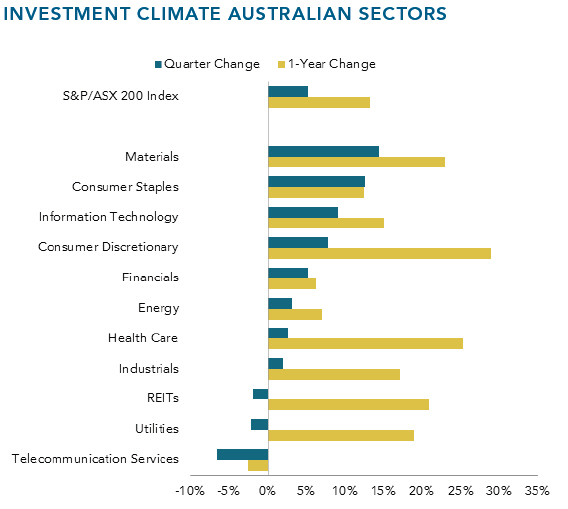

In a reversal of recent trends, mining stocks were among the best performing sectors, while REITs and highly regulated utilities were among the worst.

In country terms, New Zealand again was one of the top performing developed markets, while Australia also posted above-average returns.

Lower relative priced companies in Australia, including some of the big mining companies, were among the best performers over the quarter. Small caps also generated substantial gains over both the quarter and the year.

A similar pattern was evident in other developed markets, although small caps underperformed large in emerging markets.

On fixed interest markets, yields were stable over the quarter. Corporates outperformed government securities, delivering a positive credit premium.

On currency markets, both the Australian and New Zealand dollars made gains against the US dollar in the three months to the end of September which detracted from AUD and NZD returns for unhedged investors in foreign shares.

News headlines in the quarter were dominated by the wash-up from the Brexit vote in the UK, the narrow return of the Liberal-National Coalition in Australia’s general election, the continuing run-up to the US presidential election and speculation about the US Federal Reserve’s future actions on interest rates.

With thanks to DFA Australia.

This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly. Seeking financial clarity? We think we’re the best financial adviser in Australia, click to see the reasons why.