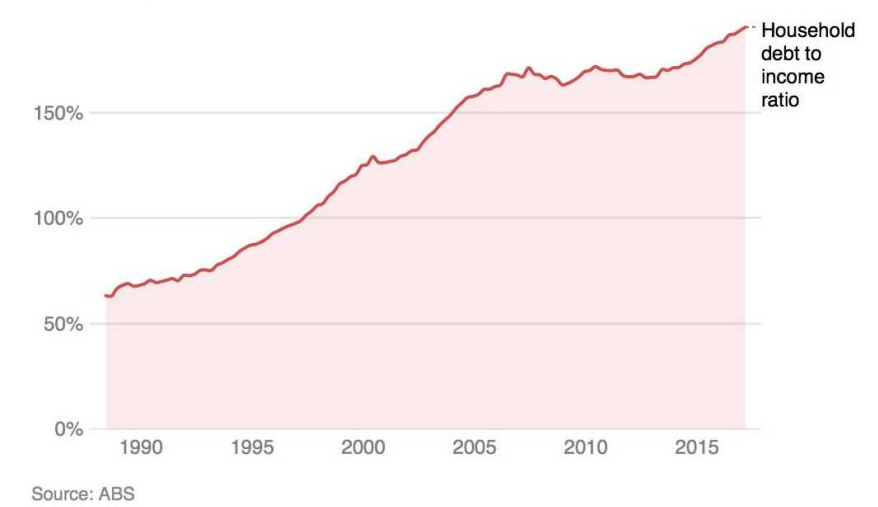

Investing is a tough deal. Our noggins aren’t truly equipped to deal with all the variables, complexities and stimuli of the modern investment landscape. While it should be simple. Save. Stay liquid. Stay diversified. Stay disciplined. Australian saving rates are back to plumbing 10-year lows. For many the house is the savings vehicle. While household debt to income is at 190%. No savings. No balance. No liquidity. No discipline.

All those houses connected to all that debt is a significant danger. Yet most of the bubble and crash talk for 2017 has been how it’s too late to invest in shares because the “US share market is too high” and “there’s a correction coming” and “we’ll be all be ruined”. Fear grabs us in different ways. For real estate it’s the fear of missing out when things are raging higher. While with equities it’s the fear of buying too late and riding a roller coaster down in a correction.

Why do people get anxious when it comes to building a liquid portfolio or even seeking help, yet throw caution to the wind when it comes to bricks and mortar, land deals or even alternative investments?

Headspace. The people who own your headspace are likely to own your financial decisions. Here are some reasons why logic often goes out the window.

Trust. Surveys say 10% of people don’t trust their partner (it’s probably higher). Further, money is often the biggest factor in relationship breakdowns. With that in mind who is going to trust a financial adviser – the media keeps highlighting how many are crooks or salesmen! Ipso facto they must all be crooks or salesmen! The inability to know who to trust or make distinctions is where many people go wrong.

When your only reference point on advice is from the media when they highlight the nefarious deeds of bank salesmen, the alternatives look promising.

There are companies now taking investors on bus tours around Melbourne to view ‘investment-grade’ properties. On the bus are an assortment of lawyers, architects, mortgage brokers and property managers. All on hand to waffle about real estate. Do they have any relevance to future returns? No, but their presence makes those on the bus feel positive about buying.

And 100% of SMSFs holding Nant Whisky Did Their Dough

Just like that word ‘guarantee’. Slap it on an unregulated investment product and investors will read into it. Believing all manner of seatbelts and airbags are built into that ostrich, cow, tree or whisky investment. A ‘guarantee’ gives them reassurance their principle is assured along with the return. Even better if that ‘guarantee’ is a nice juicy return above bank interest.

Fees. No one wants to be ripped off. At the less ethical end of the financial industry there’s been years of fees buried deep inside products, so it looks like an investor is getting advice, strategy and planning work for free. At that end of the industry there was often little value or effort in the work, so it should have been free anyway! When done properly this stuff saves money and saved costs are often too intangible to be properly valued, so little value is ever ascribed to them. Ask someone to pay directly though and the red pen comes out!

Conversely, an off the plan apartment in Brisbane a ‘find me a property’ company is advertising on the radio has no fees and charges. It’s all in the one price. Until you go to have it valued a year later and find there’s a $30,000 difference between the valuation and what you paid. They couldn’t have charged $30,000 in fees, could they? No of course not… and just ignore those cranes in the sky and the 32,000 new apartments about to appear on the market. Gulp!

Markets. These suckers move around on a daily basis. Spooky! With liquidity comes regular price discovery and regular price discovery freaks people out. Companies taking major dives is a common excuse to not invest. That’s not investing though, it’s punting on a single company, in a single sector, in a single country. Woefully overexposed to risk.

Corrections and crashes are another spectre looming over every potential investor. Corrections happen every year, except 2017 apparently. Crashes, yep they happen too, but they’re talked about more regularly than they’re ever seen. Equities aren’t the only game in town. Any portfolio worth its salt is geared to an investor’s risk tolerance and includes fixed interest, listed real estate and cash. Appropriate structure makes the market turmoil less memorable and easier to recover from.

Liquidity and transparency aren’t as explicit in real estate and alternatives. They seem safer because you don’t see them move. A great benefit to those marketing them.

Investing is not gambling. You don’t ‘play the market’. When done properly, there’s clearly less risk than borrowing $500,000 to buy one asset on one street in one city when debt levels have never been higher. And let’s not even talk about whisky, bitcoin, ostriches or tree farms.

Moreover, everyone needs income to fund their life. Concentrating wealth in a house or an alternative with a date lock puts you at risk of having to sell everything when conditions are poor or being locked in when circumstances change. Liquid assets can be sold in part as money is required. Cash sitting in your bank within days.

It’s that easy.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.