Our files say they wandered into our offices looking for retirement guidance nearly 17 years ago. Records say their current portfolio began with a rollover in 2002. They’re now veterans of investing and an example of not listening to the weenies who tell you to time the market or pick stocks.

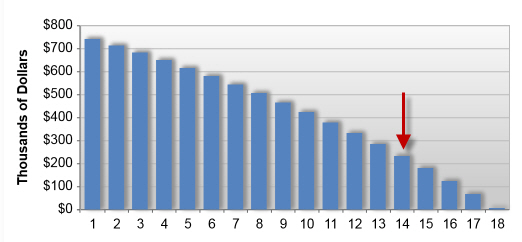

That rollover in 2002 allows us to track their progress for the past decade and a half. Now into their 70’s, their numbers are stark reading for anyone who found excuses not to invest since the turn of the century. It shows they had almost $770,000 combined back then and it’s been invested in a mix of equity, fixed interest and listed real estate. They’ve pulled out just over $875,000 across those 14 years. At last look, their combined portfolio stood around $580,000.

Yes, you read that right. They’ve pulled more out of the portfolio to live on over the past 14 years than they actually started with – and they have a significant sum left. One of the many benefits of trusting a process that has historically worked instead of chasing returns or cashing out because of a story in the media.

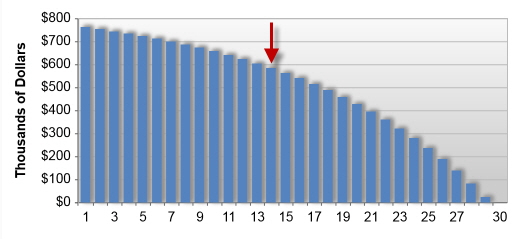

Had they exclusively been in cash it would have been a different story. They would have been able to fund their lifestyle with cash over the past 14 years, but their portfolio would now be worth $233,000. At current spending levels a cash portfolio would be gone in another 4 years.

Contrast that to their current portfolio, which will allow them another 15 years of drawdowns at current levels. Assuming their previous returns remain consistent.

To extend the life of the hypothetical cash based portfolio at the 14-year mark to last another 15 years in line with their actual portfolio, you’d would need to cut drawdowns by 66% – which would be a significant reduction in spending.

Now if our investors wanted to extend the life of their actual portfolio beyond 29 years, for an extra decade, they’d only need to cut their drawdowns by 21%. This would mean income into their late 90’s. To get the same longevity from a cash portfolio (based on cash returns this century) they would have needed to start with a portfolio nearly 50% larger.

There’s no magic here. It’s been a case of staying the course by understanding markets have historically rewarded those who’ve invested in them. The portfolio has weathered the storms of 2008 and plenty of corrections before and after. It still managed an annualised return above 7%.

When things were really bad, they could have retreated during 2008 and headed to cash, but the result wouldn’t have been a projected 29 years of income. It would mean likely exhausting their funds seven years earlier. Feeling safe has a cost.

This is what we mean when we say the biggest risk isn’t losing money, it’s running out of it.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs. Seeking financial clarity? We think we’re Australia’s best financial advisor, click to see the reasons why.