Economic Overview

Q1 2025 was a mostly negative one for global equity investors, due to a late quarter sell off, after a very positive first six weeks of the quarter. The reason? Uncertainty. The scatter gun approach of the Trump administration dominated markets. US equity market performance has been incredibly reliable in the past two years, and looked set to continue with the Republican Party controlling both the house and the senate, as investors assumed the prospect of deregulation and the renewal of tax cuts would continue to be tailwinds. But by late February, trade concerns began to weigh on equity markets. While markets are sensitive to administration remarks, there was no consensus on whether tough talk on trade, geopolitics, and the idea of Canada becoming a US state were genuine, or a just an attempt to extract various concessions from trading partners. The Australian dollar was mostly flat across the quarter against the US dollar, offering no real benefit to hedged or unhedged global investors, but there was some weakness against the Euro. In contrast to developed markets, emerging markets did notch a positive return for the quarter. Another notable, but easily forgotten story across the quarter, was the threat of a new and lower cost artificial intelligence model from China, which hit the stock prices of some the largest US companies who’d previously enjoyed an AI fueled tailwind.

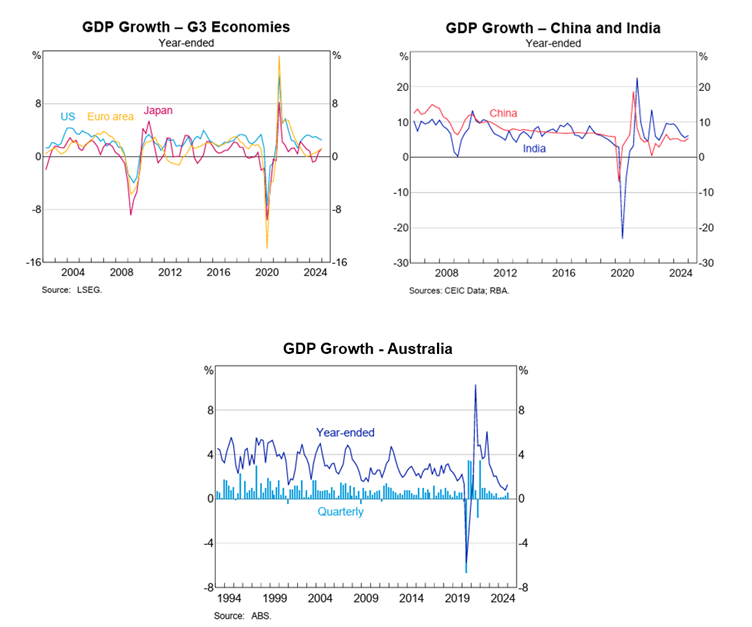

In the US, GDP came in at an annualised rate of 2.4% in Q4 2024, and slower than the two previous quarters, with gains in consumption and residential investment offsetting weakness in business investment and inventory accumulation. Consumer spending was strong, with increases in goods and services. Durable goods spiked by 12.5% over the previous quarter as consumers were potentially anticipating proposed tariffs. Motor vehicle production added 0.46% to GDP. Personal consumption has not seen a negative quarter since the second quarter of 2020, which was the peak of the pandemic shutdown. Private inventories were negative, indicating that businesses sold more than they produced in the quarter. Government spending rose by 3.1% over the previous period, adding 0.52% to GDP. Across the 2024 calendar year, GDP increased by 2.8%.

The labour market remained robust with total non-farm payrolls up by 151,000 in February, and the unemployment rate relatively stable at 4.1%. Employment trended up in health care, financial activities, transportation and warehousing, and social assistance, while federal government employment declined. Across the 12 months ending February, the unemployment rate increased 0.2%, with the number of people not in the labour force who currently want a job increasing by 414,000 to 5.9 million in February. The coming reduction of the federal workforce will have an impact on future national employment statistics. Many federal workers may be quickly absorbed into the private workforce, but at a minimum, there is likely to be an uptick in layoffs.

The Federal Open Market Committee kept the federal funds rate at a target range of 4.25%-4.50% at in March as it assessed the impact of policy changes by the Trump administration. The statement indicated a shift in sentiment, noting increased uncertainty. Policymakers initially projected gradual 2025 rate cuts for a “soft landing.” However, new tariff projections suggest potential price increases and reduced investment, impacting growth. Economic growth expectations were downgraded from 2.1% to 1.7% for 2025 and adjusted slightly lower for 2026 and 2027. Chairman Powell acknowledged the uncertainty in Washington and noted that tariffs are expected to contribute to upward pressure on near-term inflation. However, he noted that longer-run inflation expectations have remained modest.

Finally, the fiscal 2025 budget resolution passed by the House in late February authorises up to $4.5 trillion in tax cuts, primarily by extending 2017 tax cuts that were to expire this year. To reduce government spending, President Trump, and the Department of Government Efficiency (DOGE), with Elon Musk as a “special government employee,” have targeted the federal workforce, laying off thousands of employees. DOGE has promised to reduce the size of the government by $1 trillion by the start of the 2025-2026 fiscal year beginning on October 1. Additionally, there have been cutbacks and pauses in a wide range of federal grants and spending.

Source: RBA 2025

In the Eurozone, the European Central Bank cut interest rates in January and March. Annual inflation eased to 2.3% in February from 2.5% in January, according to data from Eurostat. GDP grew 0.1% in Q4 of 2024, and momentum remains weak with consumption barely growing, and the job market struggling. German elections took place in February after the previous governing coalition collapsed in November. Friedrich Merz’s Christian Democrats emerging as the largest party, with Merz signalling an intention to form a government by Easter. Following the election, sentiment among German companies improved and the flash purchasing managers’ index for March hit a seven-month high with manufacturing production returning to growth for the first time in two years. Despite the lack of formal government, Merz was able to push through plans to ease Germany’s borrowing limits before the new parliamentary session. The extra money is expected to be spent on defence and infrastructure. In addition, the souring of EU/US relations, along with the ongoing war on its doorstep, prompted European Commission President Ursula von der Leyen to propose an additional €800 billion spending to boost the EU’s defence capabilities.

In the UK, the economy avoided a technical recession in the fourth quarter, with real GDP growing 0.1%. Government consumption and inventories were just enough to overcome stagnation in household consumption and a decline in business investment. A deterioration in the fiscal outlook forced Chancellor Rachel Reeves to announce £8.4 billion in spending cuts to comply with her own fiscal rules. Given the risks of large spending cuts and rising external uncertainties, Britain is expected to be stuck in a low-growth rut. The Bank of England cut its policy rate by 0.25% to 4.5% in February.

In Japan, Q4 GDP came in at 0.6% quarter on quarter, up on the upwardly revised 0.4% figure of Q3, full year GDP growth for 2024 came in at 0.1% after the negative first half was tidied up by H2 24. Annual inflation was elevated across Q1, hitting 4% in January, although it edged back down to 3.6% in March. Food prices have been persistently high, and rice costs jumped by 92.1% year on year due to poor harvests, rising demand from record tourist numbers, and emergency government stockpile releases. Core inflation has remained at, or above, the Bank of Japan’s 2% target for nearly three years, driven by high food prices and rising wages. In a widely expected move, the Bank of Japan raised its policy rate to 0.5% in late January.

In China, GDP growth for Q4 came in at 1.6%, notching ten consecutive periods of quarterly growth. Chinese GDP for 2024 came in at 5%, slightly down on 2023’s figure of 5.4%. Core inflation was up 0.6% in January, but -0.1% in February. The People’s Bank of China held rates across Q1 25, making it five consecutive months on hold. Aside from tariff discussion, one of the bigger Chinese stories in Q1 was the emergence of the DeepSeek AI model. It is claimed to be comparable with other large language models such as ChatGPT, but at significantly less cost. Another claim is it used one tenth the computing power at Meta’s AI model. A rise in positive sentiment was also seen towards the end of the quarter with the announcement of a number of stimulus measures aimed at supporting domestic consumption.

In Emerging Markets, the Reserve Bank of India lowered the repo rate for the first time in nearly five years in February, to 6.25%. This was to maintain a neutral stance and provide a supportive backdrop for growth. Brazil’s currency slide ended during the quarter, with the real stronger against the US dollar over the quarter. Inflation remains above Brazilian central bank’s target, the policy rate has been raised three times since the start of the year and now sits at 14.25%. South Africa’s central bank cut interest rates at the end of January as consumer confidence fell, while there was political instability as the national budget presented to Parliament by the Minister of Finance was withdrawn due to controversy over a proposed Value Added Tax increase. Across South-East Asian countries, Indonesia, Malaysia the Philippines, and Vietnam all saw GDP growth finish above 5% for 2024, so the impact of any tariffs on their trade momentum will be keenly watched in 2025.

Back in Australia, data released in March showed GDP increasing by 0.6% for Q4 2024. Full year GDP growth for 2024 sat at 1.3%, topping market forecasts of 1.2% growth, it was also the strongest 12-month figure since December 2023. GDP per capita, noted as a proxy for living standards, was slightly up over the quarter by 0.1%, breaking a long-term streak of seven consecutive negative quarters, but for the year ending December 24, GDP per capita was down -0.7%.

Inflation increased 0.2% in Q4 2024 and came in at 2.5% for the 12 months ending December 24. January 25 came in at 2.5%, while the 12 months ending February 25 was slightly lower at 2.4%. The Australian Bureau of Statistics noted “the largest contributors to the annual movement were Food and non-alcoholic beverages (3.1%), Alcohol and tobacco (6.7%), and Housing (1.8%)”.

The RBA lowered the cash rate at its February meeting, and noted in its statement “inflation has fallen substantially since the peak in 2022, as higher interest rates have been working to bring aggregate demand and supply closer towards balance.” It also countered that “upside risks remain. Some recent labour market data have been unexpectedly strong, suggesting that the labour market may be somewhat tighter than previously thought.”

House prices increased in the majority of markets over Q1 25, and on a combined basis are at record highs. The combined capitals were up 0.4% and combined regionals were up 0.5% for the quarter. Sydney was up 0.4% for the quarter and up 0.9% annually, according to CoreLogic. Brisbane 0.9%, Darwin 2.8% and Adelaide 1.0% saw the largest increases over the quarter, while Canberra was the only capital to see a decline over Q1, down -0.1%. The big winners on an annual basis were Perth up 11.9%, Adelaide 11% and Brisbane, up 8.6%. Rents also continued to increase, with Perth and Adelaide leading the way, up 6% and 4.8% respectively for houses, with both seeing an 8.2% annual increase for units. While Hobart has seen flatlining dwelling prices, rents were up 4.4% for houses and 5.7% for units.

Despite record immigration numbers and ever-increasing house prices and rents, various property and university lobby groups continue to suggest an increasing number of people arriving in the country has no bearing on housing costs. At the same time, these groups, along with the Labor government, argue it’s only an increase in housing supply that can moderate prices. It’s an interesting economic proposition where increasing supply can ease price pressure, but demand apparently has no bearing!

Market Overview

Asset Class Returns

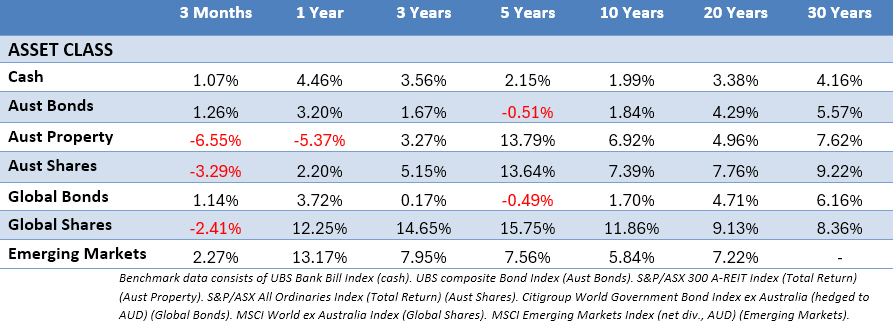

The following outlines the returns across the various asset classes to 31 March 2025.

Global stocks were negative across Q1, with the weight of the US in the index driving it south. In contrast, various individual and ex-US indices were in the green, along with emerging markets. Currency played little role across the quarter for Australian investors, with hedged and unhedged returns very similar. The hedged version of MSCI World ex Australia was down -2.62% return for Q1, while the unhedged index was down -2.41% return. US large caps were down -4.27%, while US small caps were hit harder, down -9.48%. MSCI World Ex US in USD was up 6.20% for the quarter, highlighting the performance difference between the US and the rest of the developed world in Q1.

The Australian market again struggled, and Australian listed property was down -6.55% after a similar fall in Q4. Bonds were mixed, but late quarter tariff news pushed yields down in the US. The 10-Year US Treasury yield fell in Q1, moving from 4.57% to finish at 4.21%. US 2-year Treasury Note yields also fall during Q1, from 4.25%, to end at 3.89%. In contrast the UK saw the 10-year Gilt yield moving up from 4.56% to 4.68%. In Australia the 10-year yield barely budged start to end, despite a few sharp intra-quarter movements, inching up from 4.37% to 4.39%. While the 2-Year government bond yield slid from 3.88%, to finish at 3.68%.

In the US, the S&P 500 was down -4.27% for the quarter after entering 2025 on a high, with even higher expectations and optimism driven by AI and pro-business policies. Markets hit fresh highs in mid-February, then the DeepSeek news and policy uncertainty spurred a rapid 10% correction. It was the seventh fastest since 1929. Large cap stocks fared better than small cap stocks, while value held up better with large cap value up 2% in Q1 versus a 10% fall for large cap growth. The best performers were energy, health care and utilities/infrastructure. The worst was technology, with the Magnificent Seven, accounting for almost a third of the index, falling nearly 16% which played the largest role in pulling the S&P 500 down. Tesla, being the worst affected, has seen a significant drop in 2025, down 37%. This has meant Berkshire Hathaway and Broadcom have surpassed Tesla’s market cap, leaving the question is there still a Magnificent Seven? Especially as all are significantly off recent highs, with the exception of META (Facebook), which was only off -1.5% at the end of Q1.

In the Eurozone, stocks moved up sharply in Q1 with the MSCI EMU up 7.53% in EU terms. In France, the CAC 40 was up 5.55%, while the German DAX was up 11.32%. News about DeepSeek caused investors to reassess highly concentrated positions US large caps and rotate to Europe. German elections in February brought optimism the new administration led by Friedrich Merz would pursue a pro-growth agenda, but further gains were stifled with markets pulling back in March due to worries over US tariffs on imports. Financials were the best performing sector for the quarter. Banks saw some robust earnings updates and are relatively insulated from tariff concerns. Other top gaining sectors included industrials, energy, communication services and utilities. Underperformers included consumer discretionary, information technology and real estate.

In the UK, the broad stockmarket increased across Q1 driven by a strong performance from larger companies. The large cap FTSE 100 was up 5%, although sentiment towards UK small and mid-sized companies remained poor, with the mid cap FTSE 250 down -5.56%, and UK small caps down -4.89%. Large cap financials, energy and healthcare sectors benefited in a similar way to European stocks from the rotation away from large US tech stocks. The challenging domestic economic outlook drove poor performance in many consumer-facing sectors such as housebuilders, retailers and travel and leisure. As a result, the consumer discretionary sector was the largest drag on market performance over the period, followed by technology and basic materials.

In Japan, The Japanese stockmarket declined in Q1, with the broad market TOPIX Total Return index down -3.4% in yen terms. The Nikkei 225 underperformed the TOPIX, down -10.72% due to weak performance in large cap stocks, particularly in the technology and export sectors. Most of the selling pressure was driven by uncertainty surrounding Trump tariff policies, and increasing concerns about the risk of a US recession. This was exacerbated by an announcement towards the end of March that the US would impose a 25% tariff on imported cars. As a result, that’s why exporters and technology-related companies saw heavy selling. In contrast, several Japan-centric positives supported stock prices in sectors such as financials. Rising Japanese government bond yields, driven by positive inflation and wage growth data. An announcement by Berkshire Hathaway that it was increasing stakes in Japanese trading houses, along with increased defense spending by the Japanese government, were also seen as positives.

Asia (ex-Japan) and Emerging markets were positive in Q1, with Asia seeing modest gains. MSCI AC Asia ex Japan Index was up 0.85% in Australian dollar terms, while the MSCI Emerging Markets Index was up 2.27%. The strongest performers were Poland, Greece, Czech Republic and Hungary, all supported by an improved outlook for the Eurozone following Germany’s fiscal policy changes. China also did well as the market benefited from optimism about its AI capabilities following the initial release of DeepSeek’s lower-cost open-source AI model. Chinese government stimulus measures, such as interest rate cuts, support for the country’s troubled property sector, and liquidity injections, also boosted investor confidence. The Korean market gained, led by a rebound in performance from DRAM chip producers, who benefited from an improving pricing environment. The UAE and Saudi Arabia also posted positive returns. Taiwan saw double digit negative returns, as uncertainty relating to US trade tariffs hit tech stocks.

The Australian market (All Ords Accumulation) was down -3.29% in Q1, with over half the sectors in the red. Materials were up slightly at 0.72%, but were countered by financials down -2.58%. Utilities, communication services and consumer staples were the best performers, although it was only utilities and communication services that saw single digit returns, up 2.21% and 1.85% respectively. Aside from REITs, the worst performers were energy which saw a second poor quarter, health care and information technology, which was down -18.23% off the back of board changes and downgrades at WiseTech, the largest tech company on the ASX. Finally, the ASX Small Ordinaries fell -2.00% over Q1, albeit doing slightly better than the All Ords.

This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.