Only seven wealth managers in Australia adhere to a global fiduciary standard. We’re one of them.

Confused about investing? Get our book: Your Investment Philosophy

How does an investor find a fiduciary financial advisor? Today it’s easier than ever to find an advisor you can trust.

At Mancell Financial Group we’ve always held ourselves to the most rigorous fiduciary standards with a duty to our clients, but given the history of financial advice in Australia we didn’t believe it enough to say: “trust us”. We wanted to ensure potential investors had absolute peace of mind they were dealing with an financial advisor they could trust.

In 2016 we submitted ourselves to be accredited as a fiduciary financial advisor with the Centre for Fiduciary Excellence (CEFEX).

Upon completion of that exhausting process, Mancell Financial were officially certified by CEFEX in June 2016 as adhering to all their practices and criteria in the conduct of a fiduciary investment advisory business. Mancell Financial became only the second CEFEX fiduciary in Australia part of an elite group of global investment advisors who successfully completed the independent CEFEX certification process. Today Mancell Financial are one of only seven fiduciary financial advisors in Australia.

Upon accreditation, General Manager of CEFEX, Carlos Panksep noted Mancell Financial’s standards were of the highest quality. CEFEX Certification renewed 15th April 2024

“Through CEFEX’s independent assessment, the certification provides assurance to investors, both institutional and individual, that Mancell has demonstrated adherence to the industry’s best fiduciary practices.” Mr Panksep said.

Importantly, Mr Panksep acknowledged that “this indicates the firm’s interests are aligned with those of investors.”

A fiduciary is a general legal term for someone in a position of trust. That person must exercise a very high standard of care when acting on another’s behalf.

Fiduciaries have an ethical and legal duty to always place the other person’s interests above their own. This arises out of the nature of the relationship and goes beyond the care that’s required in general business, contractual or social relationships. The two most fundamental duties of fiduciaries are loyalty and care. These duties form the foundation that gives rise to the specific responsibilities of investment stewards, advisors, trustees and managers established in contemporary laws and regulations. Thus, the fiduciary standard is said to be principles-based, meaning that a fiduciary’s actions must always conform to the guiding principles of loyalty and care.

Where there is a fiduciary relationship between a financial advisor and their client, the advisor must exercise the highest standard of care under the law. This recognises the comparative vulnerable situation of the client and the special trust placed in the advisor.

A fiduciary financial advisor is someone who has responsibility for the management of the assets of others and is therefore in a special position of confidence, reliance and trust. The standard of conduct required of fiduciaries is considered the oldest, strongest, and most revered standard in law

Essentially, there are obligations on the advisor to:

CEFEX is an independent global assessment and certification organization. It works closely with investment fiduciaries and industry experts to provide comprehensive assessment programs to improve risk management for institutional and retail investors. CEFEX certification helps determine the trustworthiness of investment fiduciaries. It’s the certification to look for when searching for a fiduciary financial advisor.

The important thing to note about our CEFEX certification is it’s an ongoing process. We need to submit to annual audits to ensure we are continually meeting the criteria set, all of our investment processes are scrutinized to ensure we maintain our status as a fiduciary financial advisor. This gives our existing clients (and potential clients) peace of mind that they are receiving investment advice that puts their interests first.

The CEFEX assessment process is based on the international standard, ISO 19011: Guideline for quality management system auditing. The assessment is evidence-based. All work is reviewed by the CEFEX Registration Committee to ensure impartiality and consistency.

The assessment includes document review, client file sampling, on-site visits and interviews with senior representatives at our firm. The assessment is conducted by CEFEX Analysts who must hold the Accredited Investment Fiduciary Analyst ® designation and a minimum of the ASPPA 401(k) Administrator (QKA) designation for ASPPA certifications. CEFEX Analysts maintain annual assessment training. These rigorous standards underline why it’s hard to find a fiduciary financial advisor in Australia.

The assessment methodology includes questionnaires on regulatory matters, developed by expert attorneys.

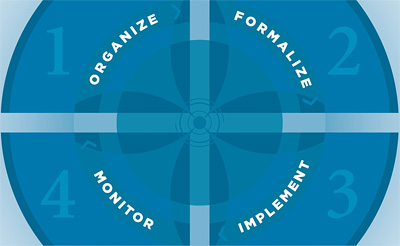

The CEFEX certification standards are organized according to a four-step management process. The steps are analogous to the global ISO 9000 Quality Management System standard, which emphasizes continual improvement in a decision-making process.

We’re extremely proud of this ongoing achievement. We’re only one of two CEFEX certified firms serving Tasmania and Canberra, and one of only seven fiduciary financial advisors in Australia.

If you’d like to know more, a full copy of the standard can be downloaded from CEFEX at www.cefex.org Alternatively, you can view our most recent CEFEX Fiduciary Registration.

If you’d like to experience the difference of working with a fiduciary financial planner, we have offices in Tasmania and Bungendore covering the Canberra region, but no matter where you are located we have a long history of helping with clients across Australia. Feel free to call us on (03) 6440 3555 or fill out the form below to arrange an obligation free discussion about your future.

Alternatively, learn more about the types of people we help.

For informational purposes only. All information is given in good faith and without warranty and should not be considered investment advice or an offer of any security for sale. Fiduciary practices do not guarantee against loss. Are you searching for Australia’s best financial adviser?

Level 1, 41 Mount Street,

Burnie, Tasmania, 7320

16 Rutledge Street,

Bungendore, NSW, 2621

mfg@mfg.com.au

03 6440 3555

Mancell Financial Group is an Authorised Representative No. 226266 and Credit Representative No. 403187 of FYG Planners Pty Ltd, AFSL/ACL No. 224543. ABN 29 009 541 253.

This website is for informational purposes only and the information contained is of a general nature and may not be relevant to your particular circumstances. The circumstances of each investor are different, and you should seek advice from a professional financial adviser who can consider if particular strategies and products are right for you. MFG has professional financial advisers in Burnie & financial advisers in Canberra if you are seeking advice. In all instances where information is based on historical performance, it is important to understand this is not a reliable indicator of future performance. You should not rely on any material on this website to make investment decisions and should seek professional advice. Notwithstanding our GAIA membership, MFG does not claim to be independent under section 923 of the Corporations Act.

Copyright © 2024 Mancell Financial Group | Privacy Policy | Financial Services Guide | Our Advice Process | Fact Find | What's Important? | TOS & Disclaimer