We’re deep in a global pandemic. The positive? Governments are responding.

Unprecedented times call for unprecedented measures. Interest rates to near zero. Governments putting money into bank accounts. Financial support for business. Government quickly realised the time for half measures was over. President Trump especially. He’s got an election to win at the end of the year. Previously he’d been coasting to victory. With the US economy pummeled, Trump’s no longer on a victory lap. Trump’s big stimulus may not be the last.

On an individual level, the important thing is getting through this. Physically and mentally healthy.

If you are feeling under stress that would be completely normal. If you’re feeling great that can be completely normal too. Various people will respond in various different ways. The important thing is decision making. Your adviser can help with clarity around decisions. Rarely are quality long-term decisions made when someone is feeling panicked or euphoric.

Optimism vs Pessimism

Feel free to watch this video before reading on.

It’s easy to look at these falls and conclude, ‘yes, they always come back.’ However, if we look at those charts, they’re absent something we’re being hit with right now. The narrative. The news. The story. The massive dose of uncertainty that was in the air. There was information swirling around all those occasions that led people to conclude it was time to get out. Just as there is right now.

If you can block out the noise surrounding the COVID-19 pandemic it will be much easier to be there for the recovery.

Will there be a recovery? It’s a very black and white scenario. Either we believe this gets better. Believe there will be a cure or a vaccine (the first live test has happened). The spread will eventually be contained. The recoveries will outpace new infections. Stimulus puts a floor under markets. Demand swells. Companies get back to business. Economies and markets come roaring back.

Or we don’t.

If we don’t, then there are much bigger problems than our portfolios or money. That’s a serious statement. The toilet paper wars haven’t shown humanity in its best light, but the best global medical minds are on the case. No one can seriously argue that a cure or vaccine won’t be found. That argument is a bet against all of humanity’s progress to this point. We’re leaning on the side of optimism. It hasn’t failed yet.

Reactions

A recovery will eventuate. The timing is uncertain. The economic impact is unknown.

This event is provoking various reactions.

The expected – some people are concerned about their portfolio; most are happy to wait it out.

The unexpected – some people are excited without considering broader implications.

Don’t panic. Don’t make impulsive changes. Stick to your plan. Our financial advisers reinforce these messages regularly. It stops investors harming themselves long term. It’s also beneficial to help people understand the benefits of rebalancing a portfolio after a fall. After market falls, expected returns increase. This can benefit investors in the recovery.

These messages are everywhere now. It’s good that investors have more clarity around market falls. Understanding they’re not fatal. In some ways, this has worked too well. Don’t make impulsive changes also can apply to buying as well as selling.

We’ve seen instances of investors broaching the idea of margin lending or pulling money from mortgages to take advantage of what they see as an unprecedented opportunity.

This is where good financial advice and a sober second opinion prove valuable. After a full analysis, it may be advantageous for the right investor with a long horizon. However. ‘Is this a good opportunity?’ needs to be accompanied by ‘how secure is my employment?’. Economic activity is stalling. Imagine taking on a bravado loan, seeing another sell off and losing a job if your house price declines.

There hasn’t been a glove laid on real estate yet, but Airbnb rental entrepreneurs now have no income. Open houses will go quiet. Auctions be postponed. International students who fill apartments are now tethered to their own country. While guidance from Real Estate Institutes in Australia has been slim, the British Columbia Association of realtors called this an “unprecedented paralysis of economic and social activity”. Jobs are tenuous in many industries. Maybe not the time to be dipping into home equity. A personal financial planning picture needs to be fully weighed against the lure of investment opportunity. Feeling negative or positive, the reference point before making any decision should be a discussion with your adviser about your goals and plan.

Timing the Market

Superfunds are overwhelmed. People are bailing to cash. Visit any internet investment forum and you’ll see why. This isn’t a permanent decision. They’re intending to return when this all blows over. They concede they missed the sell off and have now crystallised a loss. But they apparently know when it will be time to get back in.

While the recovery will eventuate, the path to the recovery won’t be smooth. Bottoms are bottoms in hindsight. The bottom might come with a 20% positive month, followed by an 15% drop. Almost back to where things started. That might give someone second thoughts.

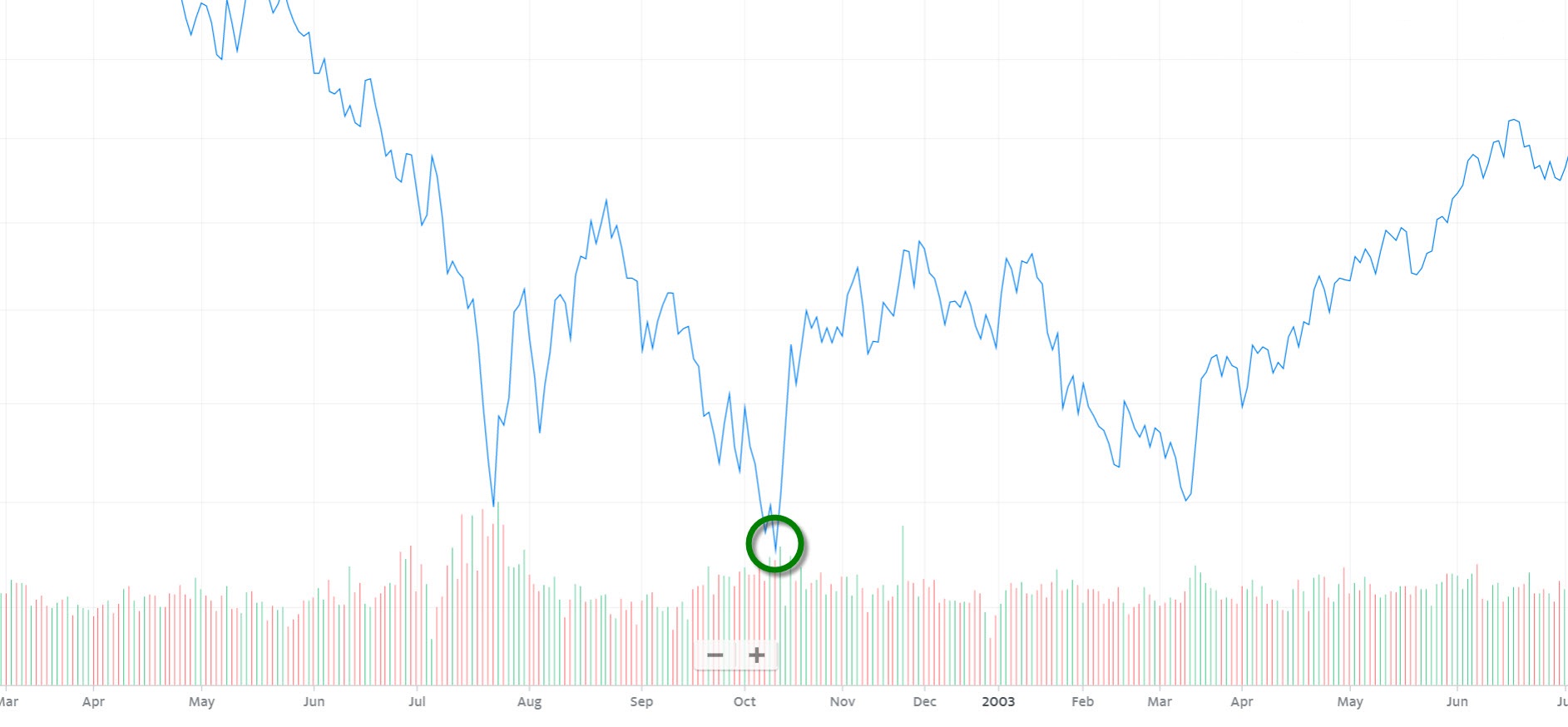

Three charts to highlight the folly of market timing. This is the US S&P 500 in the aftermath of the dotcom bubble and 9/11. This chart’s a monthly chart. The bottom appears evident. We’ve highlighted it with the green circle. There was another sell off, but if an investor managed to pick the bottom and hold their nerve, the rewards would flow. It all seems very clear.

Now the same chart, just on a weekly basis. It’s a little messier. Not just a straight up, down and up. Note another dip and recovery appears to the left of the circle (the true bottom), but it wasn’t quite the right point to re-enter.

Now on a daily basis. The movements are no longer smooth. A recovery that seemed very clear in the first chart is now filled with much more noise to navigate. Picking the bottom in October 2002 looked pretty smart until the sell off in January 2003 which lasted 6 weeks. It was nearly back to that first bottom again before the upward momentum stuck.

An investor jumping to cash creates a decision-making chain. When exactly do they feel safe? What signals do they use and what noise do they disregard? How do they successfully identify their re-entry point when there is no certainty around the bottom? There may be false starts before the recovery fully gathers a head of steam. How does someone not confident enough to sit tight find the confidence for their re-entry?

If you have any concerns, speak to your adviser. No matter what impact this virus might have, it is always good to review your overall financial goals and objectives, and think about making them stronger. That’s the smart move in stressful times like these. We are all in this together, stay calm and stay healthy.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.