Things to consider as the end of the financial year approaches.

Salary Sacrificing Bonus

Awarded a bonus at work? Depending on circumstances, it may be worth salary sacrificing the bonus into superannuation. This can increase retirement savings & lower taxable income. The benefit depends on the difference between the 15% tax on super contributions (aside from the additional 15% for those earning over $250k) and your marginal tax rate. Also be aware of the concessional contributions cap of $27.5k.

Lump Sum Contributions & Carry Forward Cap

If you haven’t used your concessional contribution limit of $27.5k and have money available to contribute, this is the opportunity. Further, if you have a larger sum of money available to contribute and your balance was under $500k at the start of the financial year, the carry forward cap is also an option. For example, there is now $130k of space across five years since 2019 (3 x $25k & 2 x $27.5k), if your superannuation account received concessional contributions amounting to $50k across the five years, there is $80k of unused concessional contribution space available.

Co-contributions

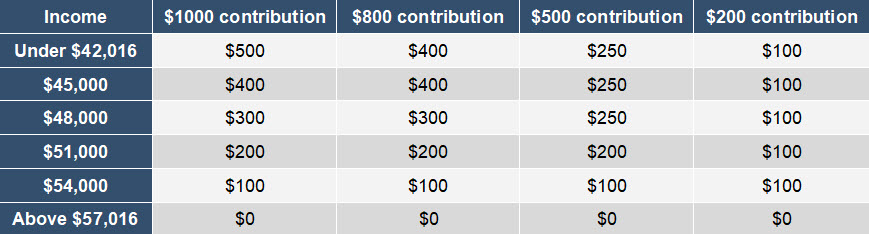

If you earn below $57,016, there is the opportunity to make a super contribution and receive a co-contribution from the government. The table below shows the potential scaling options.

Spousal Contributions

You can contribute to your spouse’s superannuation and receive a 18% tax offset on up to $3,000 when filing your return. The maximum tax offset is $540, on a contribution of $3,000 and your spouse’s income needs to be under $37k. Above $37k there is a partial offset, but over $40k there is no eligibility.

Capital Gains/Losses

Time honoured tradition to dump any investment stinkers before the end of the financial year.

Realising losses is especially beneficial if you have gains elsewhere you want to offset. Just be aware, the ATO doesn’t like wash trades where you sell and immediately buy back the next day. There needs to be a 30 day break before you buy back the same asset and still claim the loss.

Annual Super Pensions Withdrawal Minimums

Superannuation minimum pension withdrawals were halved during covid and this was extended until the end of the 2022/23 financial year. The extension is over and they revert back to the long term minimums for 2023/24 and onward.

Annual payments are calculated on the account balance at July 1.

SMSF Pension Payment(s)

SMSFs may work on a single annual pension payment instead of multiple payments through the year and are often done manually. If this is the case, it’s important to ensure the payment or even the final payment is made before June 30 and that it reaches the minimum threshold for your age bracket above.

Bringing Forward Expenses

There is always the opportunity to bring forward tax deductible expenses from the coming financial year, into this financial year. These include pre-paying investment loan interest, income protection policies and private health insurance and any work related subscriptions or memberships.

Timing of Payments

If you are making superannuation contributions, don’t wait until June 30 to take action. Super funds generally advise investors to make BPay payments by June 27 to ensure they make the cut off.

Final Things to Check at End of Financial Year

Are your beneficiary nominations current?

Have you reviewed your pension payments and are they adequate?

Have you collected your receipts for your tax return?

Do you understand what deductions you can claim?

Are you under or over your super contributions caps?

As always, discuss all strategy options with your adviser.

This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Are you looking for a financial advisor in Canberra? This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.