You may remember earlier in the year we cautioned about Nant’s whisky buyback scheme, where investors would put down $25,000 so Nant could hold 2 barrels of whisky in their name to mature. After four years Nant would buy back the whisky for $36,007 – a return of 9.55% per year.

As we said at the time it raised several key red flags of alternative investment opportunities:

Uses the word ‘guarantee’ somewhere – check. Uses a celebrity (Matthew Hayden) to spruik their wares – check. Offers a specific return well in excess of anything you’d receive from a bank – check. No Australian Financial Services License (AFSL) when offering what is essentially a financial product – check.

Unfortunately, there are plenty of investors around Australia who don’t receive good financial advice. Consequently, throughout the year there have been stories of investors encountering resistance when trying to get their money back from or locate their barrels.

We also learned that Nant had branched out beyond whisky. They were now offering a five-year deal to invest in Angus cattle – coincidently also offering a 9.55% yearly return!

Late in the September quarter a story emerged in the media regarding some unhappy investors in this Angus cattle scheme. A couple from Melbourne had sunk $120,000 (their life savings) into buying four herds of Angus cattle – 40 cows in total. Four months into their five year investment, the couple came across media stories regarding the trouble Nant whisky investors were having. The couple then panicked about their Angus investment.

This began a frustrating attempt to find out where their cattle were located on properties in Queensland. It wasn’t long before they were engaging lawyers and the Queensland rural crime investigation squad in an attempt to get their money back.

There is quite a bit of “he said, she said” between the parties we’ll ignore, but there was a predictable resolution from the couple:

I’d say to anyone with a nest egg, that if you want to save for your kids’ future, just stick your precious, hard-earned dollars in the bank.

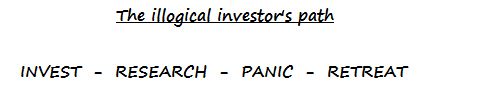

Which is the inevitable conclusion to what we like to call the illogical investor’s path.

The illogical investor’s first step was to invest, in this case in something they didn’t understand, possibly due to seeing glossy advertising promising a very healthy 9.55% return. They then stumbled across some news that cast their investment in a different light, leading them to then do some research about it. What they found out left them in a panic, trying to reverse their mistake. Finally, they resolved that it’s best to invest “safely” by sticking cash in the bank, with no possibility of capital growth, their capital subject to erosion by inflation while being taxed at their marginal rate.

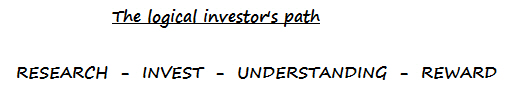

Contrast the illogical investor’s path to the logical investor’s path.

The first thing the logical investor does is research. This can be ensuring the people they are dealing with are reputable and regulated, and those people can clearly show the investor the method behind their investment process. Only then does the logical investor take the next step of investing their money. If their investment hits a rocky path the investor already has the understanding that this is to be expected and volatility is a normal part of an investment journey. Eventually the logical investor can enjoy the reward of their investment because they’ve engaged in a process that’s historically delivered returns in line with the level of risk they were prepared to take.

Finally, back to Nant. In recent weeks ASX listed company Australian Whisky Holdings has entered into an agreement to buy Nant’s distillery business and the Nant Estate in Bothwell. Australian Whisky Holdings has opted to bypass acquiring the cattle business. No one yet knows exactly what this acquisition will mean for investors in the whisky barrel scheme.

Aren’t alternative investments exciting?

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs. Seeking financial clarity? We think we’re the Australia’s best financial advisor, click to see the reasons why.