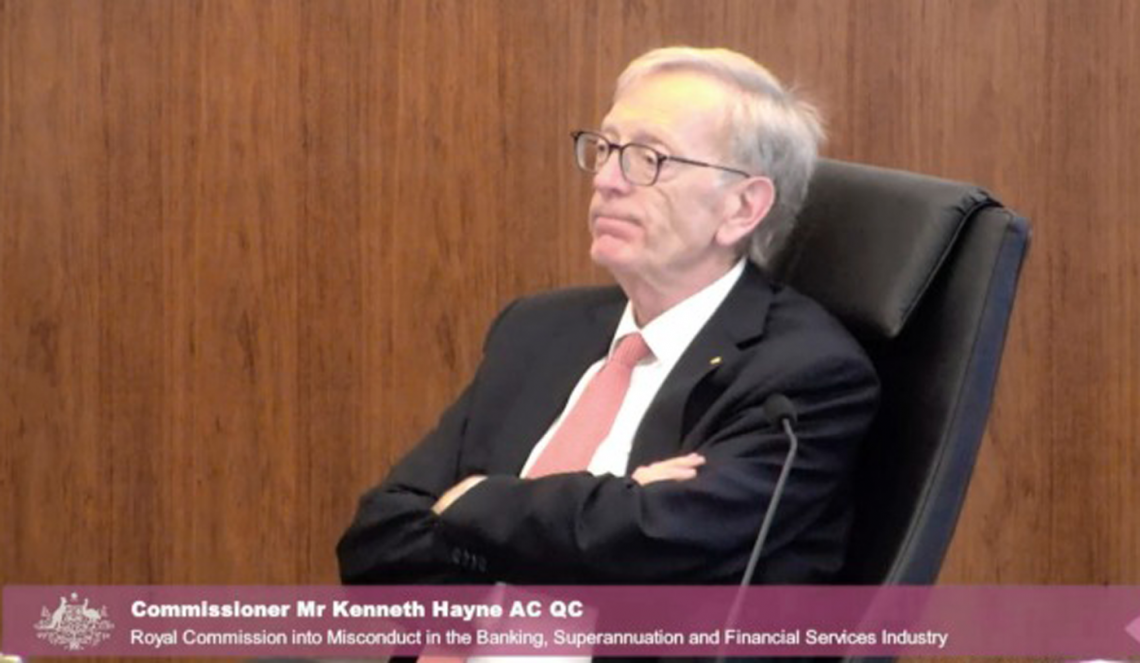

The findings and recommendations from the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry have been delivered. Commissioner Kenneth Hayne made 76 recommendations and the early noises from both sides of politics were 75 of those recommendations will be implemented.

Whether this is true or not, is another matter entirely. Along with how the recommendations are actually implemented. Politics tends to move on very quickly to other issues where there’s less agreement between the parties. Despite their contrition, anything the banks (or any other vested interest) want watered down will be subject to furious lobbying behind closed doors. Friendly media mouthpieces will also do their best to soften the public along these lines.

Bringing us to the reaction from the media throughout the affair. Before the Royal Commission was called many notable financial and business journalists were in furious opposition, “a royal commission into the banks is a complete waste of time,” said one. When the Royal Commission was sitting and the ongoing horror stories were being told by customers and clients, the financial and business journalists were suddenly outraged. Many screaming “I admit I was wrong” and “it was worse than we imagined”.

On release of Commissioner Hayne’s findings, the tide had slightly turned again. With the banks escaping mostly with a wet lettuce bashing, the commentators who were first against the royal commission, before pivoting to outrage at the revelations, were now patting Hayne on the back for “not going too far”.

Weathervanes have a good sense of where the wind’s blowing from. When even the under-fire banks weren’t bothering to do public relations in the midst of the dirtier royal commission revelations, supposedly independent journalists had no choice but to align themselves with the public mood. With the RC all over, it’s back to business as usual for the financial media. The wooden baseball bats have been tossed on the bonfire. The long game is maintaining access for stories. For the better-known media personalities, there’s those high paying MC and speaking gigs at bank functions and conferences to think of!

Keep this in mind about financial media toadies. If you need trusted financial direction or an opinion on a financial matter, your adviser should be the one to give it. You know it will always be consistent.

Many of the recommendations relate to banking, but we’ll focus on the recommendations relating to financial advice and other points of interest.

Annual renewal & Fees

The current opt-in period is recommended to be shortened to one year. Obviously, some clients find continually opting in frustrating and our compliance burden increases, but this is the reality now. There will also be an explanation of fees and services, but our fees are already fully disclosed.

Disclosure & Insurance

Anyone receiving an insurance commission can’t call themselves independent, unbiased or impartial according to the Corporations Act. We have no affiliation with product providers, banks or financial institutions, neither does our financial services licensee, FYG Planners. We do receive insurance commissions, but we choose insurers and premiums on their merits and suitability for each individual client. These commissions are already disclosed in your advice documents. Which brings us to the insurance commissions which may be reduced to zero.

Grandfathered commissions

These commissions are paid from within investment platforms and are a legacy from old life company products and some of the ‘no frills’ platforms. Occasionally clients have these products and if it’s in their best interest we recommend alternatives.

Superannuation

The most notable superannuation recommendation is that investors have one default account. The first superannuation account a person has will remain their only account, unless they choose otherwise. It’s suggested a framework is to be developed to ‘staple’ a person to their account. This is possibly a better idea for younger investors who have been prone to accrue multiple accounts due to either inattention, or employers designating a new account for them due to workplace agreements.

Bank Financial Advice

One of the missing elements was any separation of financial advice and product sales. Many expected there would be something relating to vertical integration, given much of the outrageous conduct exposed at the RC stemmed from employees pushing their company’s products. As we’ve said in the past there’s advisers and there’s salespeople, unfortunately the consumer still doesn’t get a clear distinction.

Mortgage Broking

Mortgage brokers were the surprise loser. The key recommendation was the removal of all trail commissions for brokers, to be replaced with an upfront fee to be paid by the borrower to the mortgage broker for the work done. This was the one point that the current government didn’t suggest they’d implement.

With less lending originating from bank branches the mortgage brokers have been the largest originators of mortgages in the country. It’s arguable that mortgage brokers do provide a valuable service, saving the consumer from measuring up every available loan to find the best one to fit their needs.

Summary

The Royal Commission uncovered some rotten behaviour and has firmly put those at fault on notice. Hopefully shining the light will ensure the ruthless areas of the financial industry clean up their act. A lack of trust often results in everyone being tarred with the same brush, meaning consumers who could use quality financial advice end up not seeking it.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs. Think you need a lawyer for a superannuation claim? Think again!